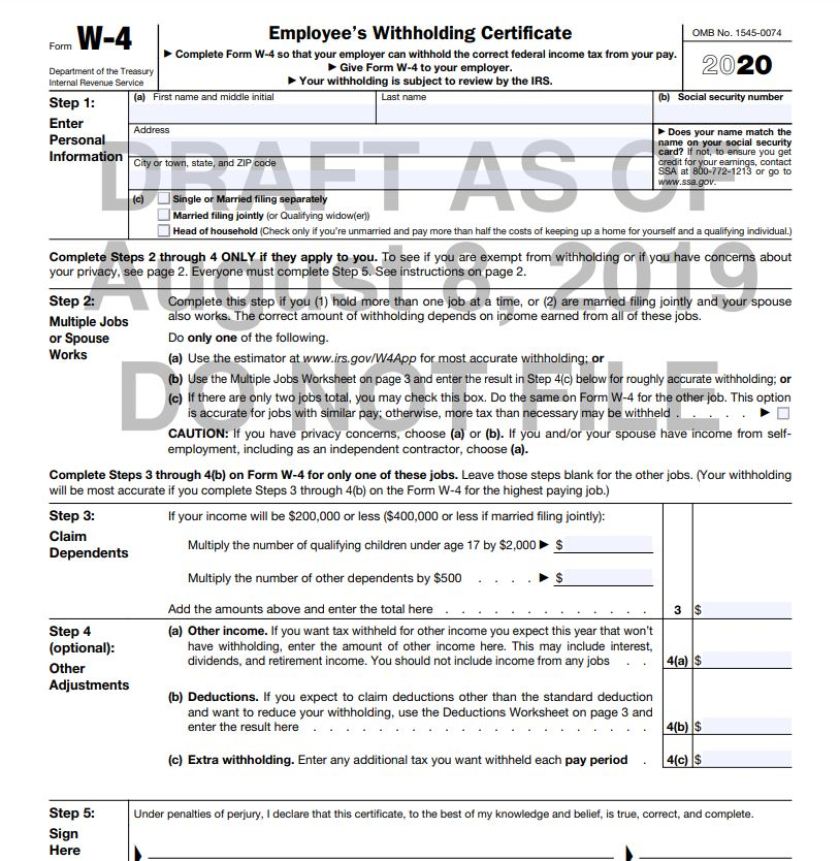

Updated W-4 for Tax Year 2020

The redesigned Form W-4 employs a building block approach to replace complex worksheets with more straightforward questions that make it simpler for employees to figure a more accurate withholding. While it uses the same underlying information as the old design, the new form uses a more personalized, step-by-step approach to better accommodate individual taxpayer needs.

Employees who have submitted a Form W-4 in any year before 2020 are not required to submit a new form merely because of the redesign. Employers will continue to compute withholding based on the information from the employee’s most recently submitted Form W-4.

The IRS is once again urging taxpayers to do another paycheck withholdings checkup this year to ensure they have the correct amount withheld for their personal tax profile.